Business Financial Management Software: Tribal

A platform for corporate finance operations.

- Service

- Custom Software Development

- Industry

- FinTech

Customer goal

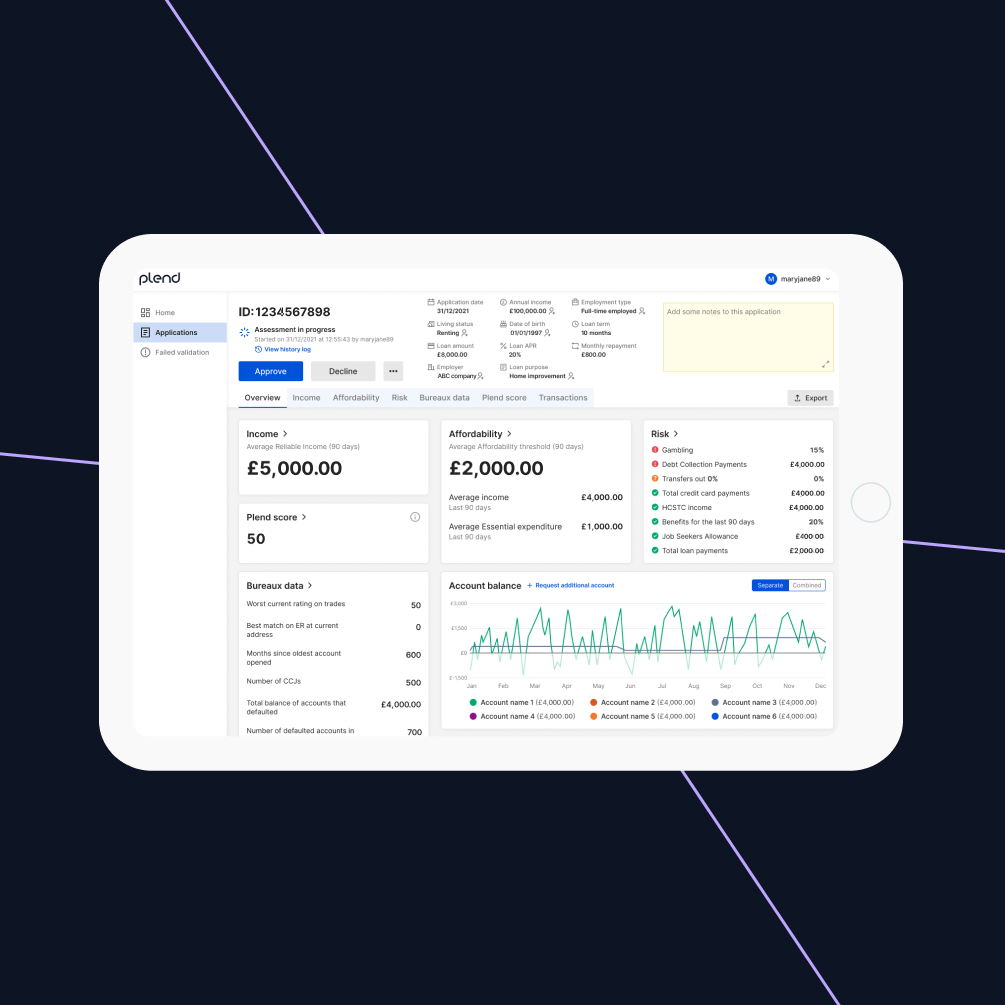

In the world of emerging markets, a sector of mid-sized, high-growth companies is rapidly expanding. At the same time, businesses face a significant challenge: the banking infrastructure designed to support them is failing to keep pace. Recognizing this gap, our client Tribal steps in to provide the solution meeting the specific requirements of businesses.

From the complexities of opening a bank account and obtaining approval for a business credit card to facilitating international payments, Tribal understands the pitfalls of corporate financial management. They offer novel business financial management software to overcome these challenges and help companies thrive.

Our team at Exposit played an integral role in Tribal’s fintech software development, collaborating closely with the internal teams at the company. We embraced the OKR (Objective, Key Results) framework, ensuring that our efforts aligned with the project’s overall objectives.

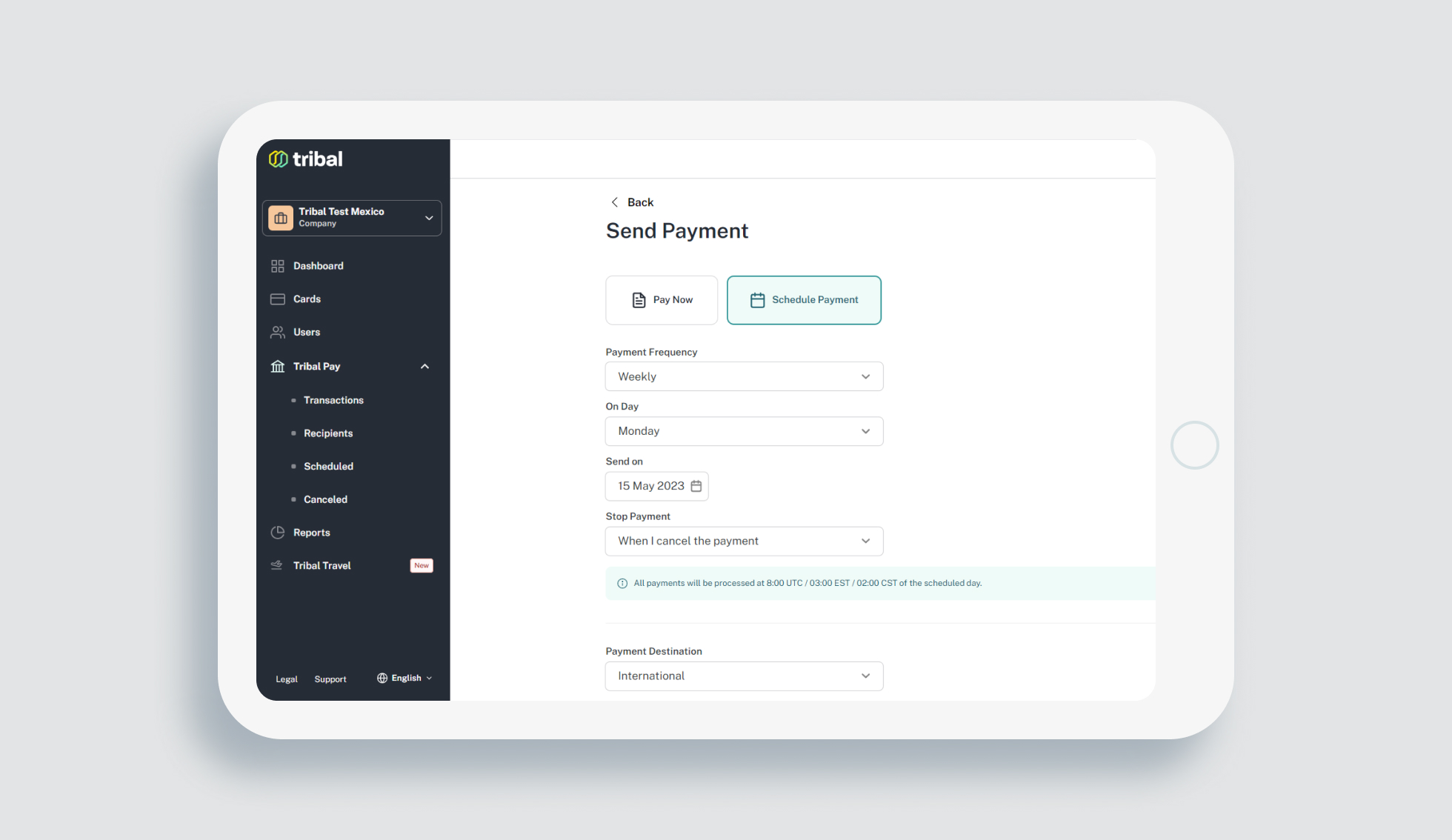

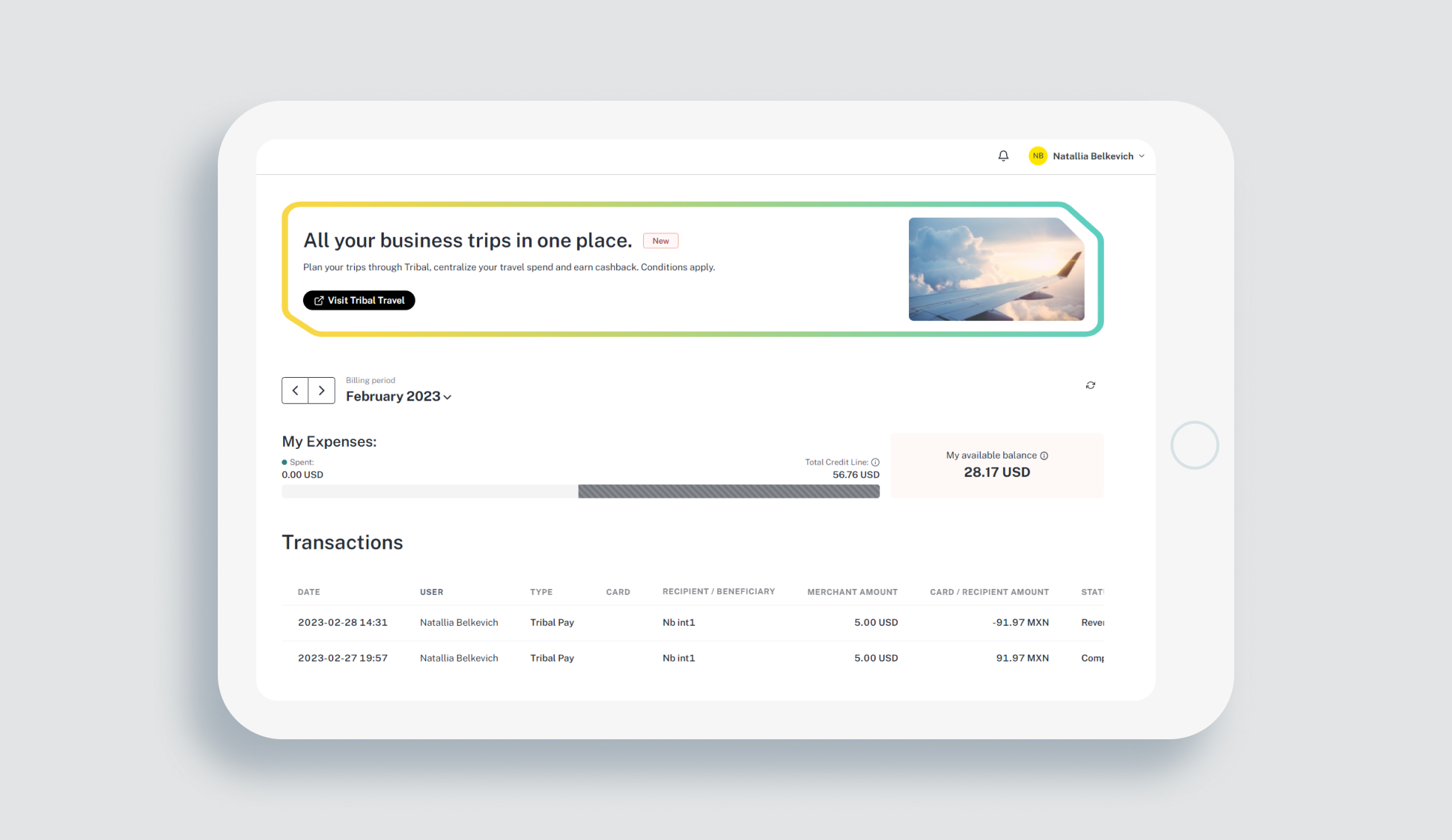

Within the framework, the team, including Exposit leading designers, selected a task that we could influence to achieve the desired outcome – increasing the Net Promoter Score (NPS) of Tribal. We identified areas for improvement and focused on enhancing the payment process. We aimed to enable users to make payments quickly and efficiently, minimize errors, expedite payment processing, and reduce waiting times.

As part of the collaboration with Tribal and fintech product development, Exposit’s programmers worked on the platform’s frontend part. Their assignment involved developing the Signup Application and Platform Application, which encompassed a wide range of functionalities.

Additionally, our developers played a crucial role in transitioning from a single-page application (SPA) version of the service to a microfrontend architecture. This transition allowed for greater modularity and scalability, enabling easier maintenance and updates across different platform sections.

Solution

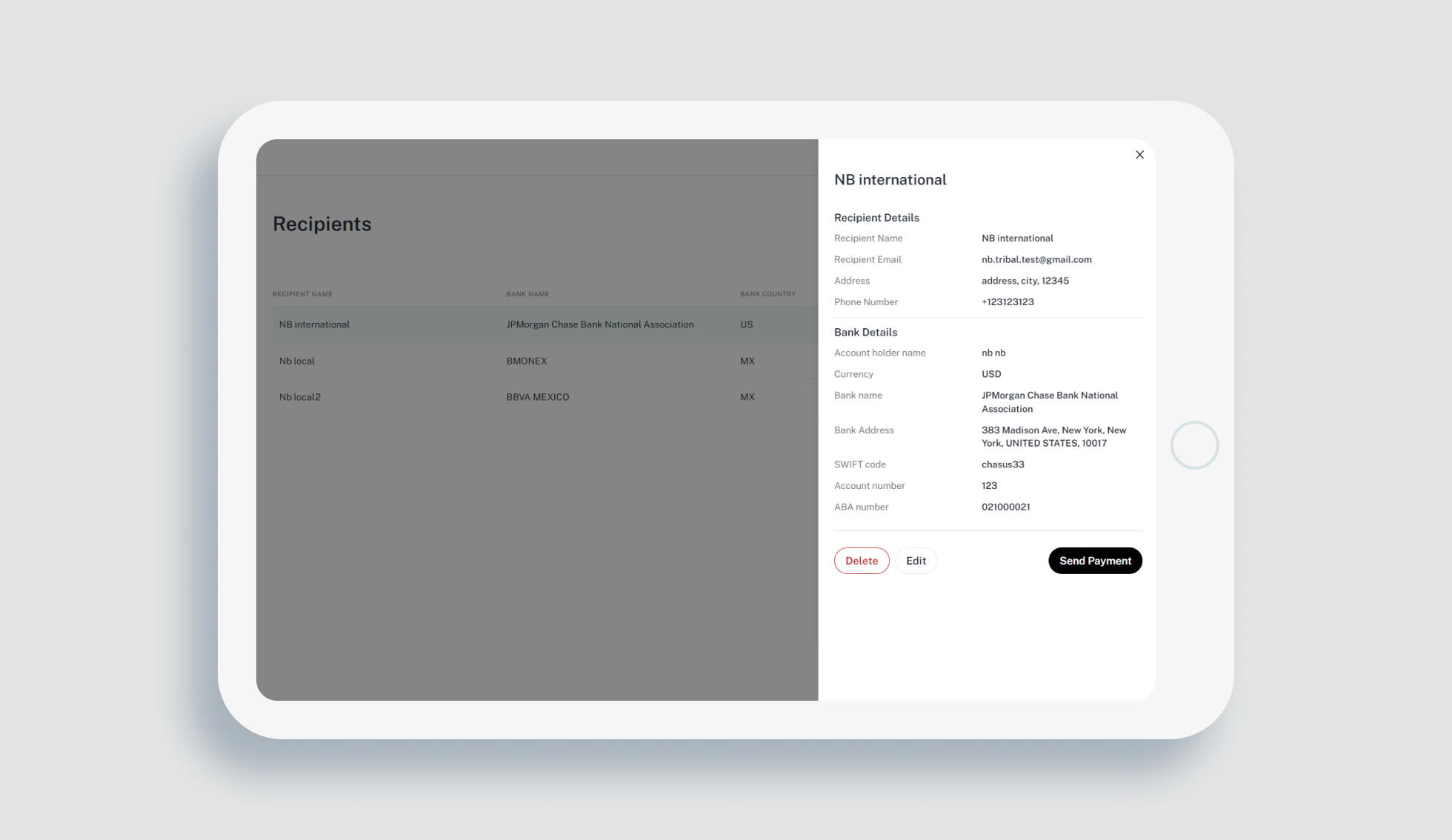

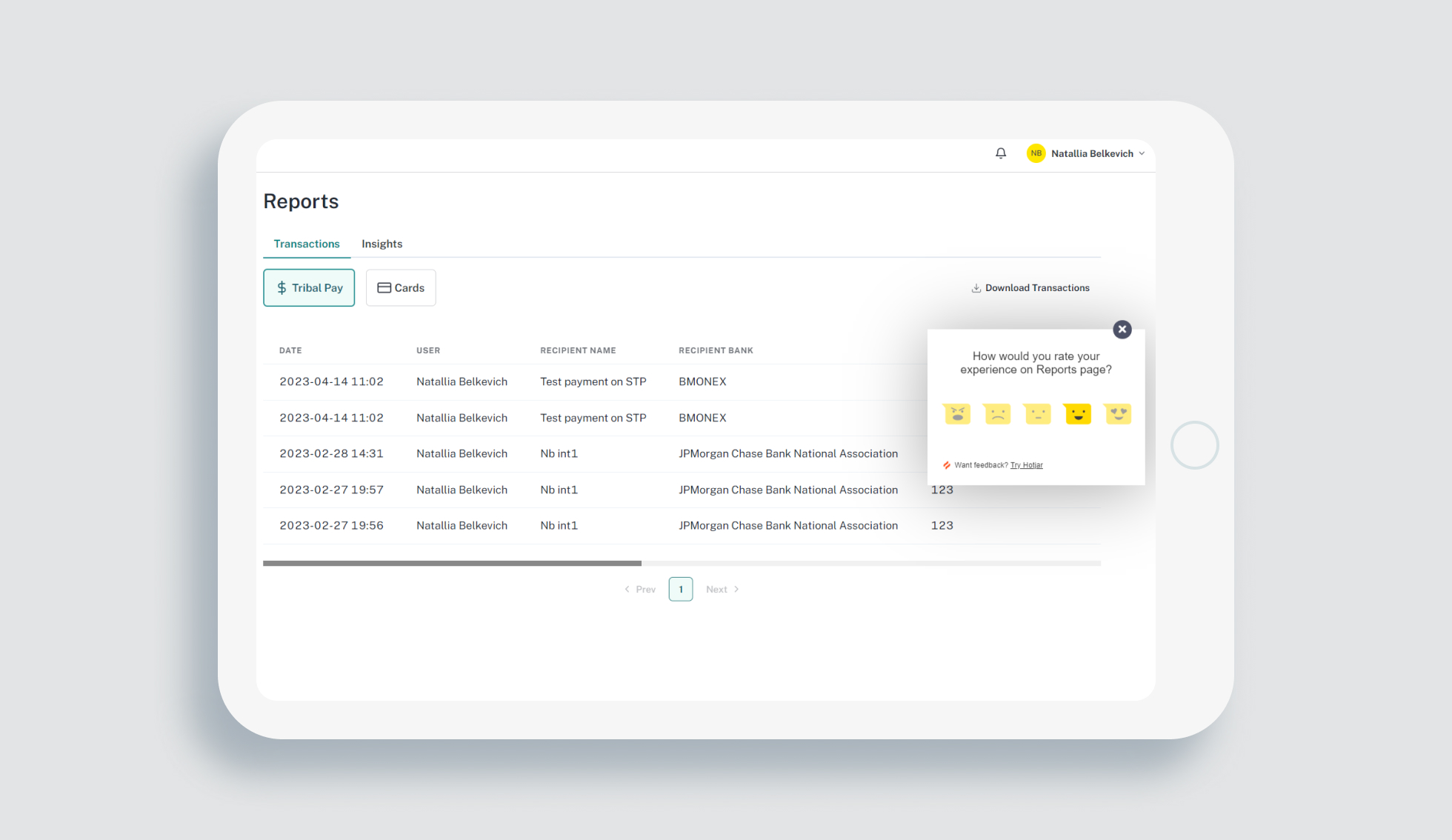

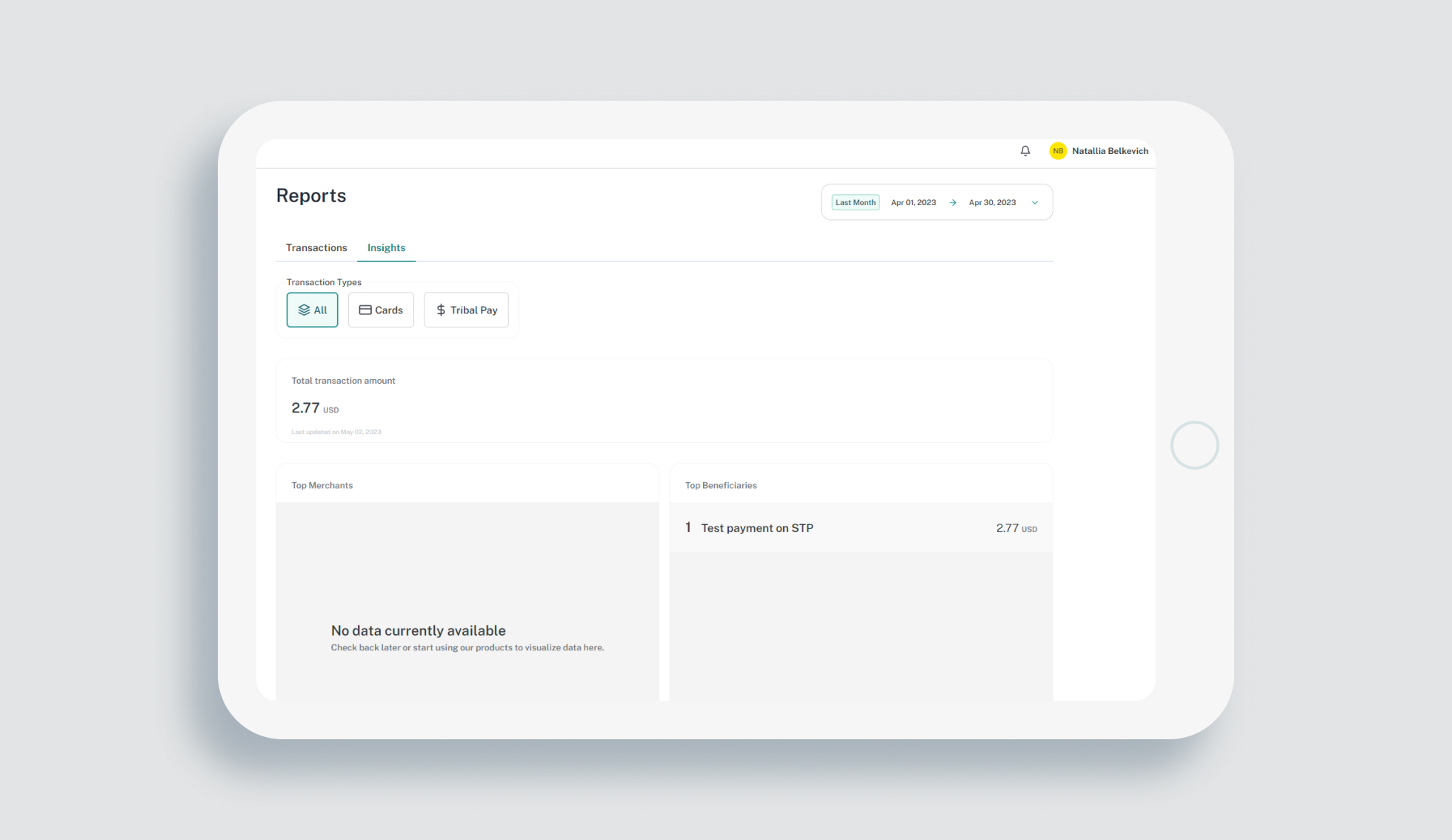

Within the collaboration with Tribal, our experts implemented several significant features to enhance the platform’s functionality. Two major features were introduced in the automated financial management system: Recipients and Approval Policies.

The Recipients feature involved creating a dedicated page to better manage each recipient, minimizing errors during payment transactions. Approval Policies were implemented to provide better control over payments, considering specific country limits for monetary transfers. In order to ensure payment safety, employees must seek management approval and confirmation for large transactions.

Additionally, the team developed the capability to schedule bulk payments. Instead of creating individual payments for each recipient, users could generate a single payment for multiple recipients using an Excel document that specified payment details and recipient lists. This streamlined the process and eliminated the need to create multiple payment requests.

Furthermore, we integrated the functionality of scheduling regular payments, such as loan repayments, into the bulk payments feature. By merging these two functionalities, users could efficiently manage recurring payments and bulk transactions.

Exposit’s leading designer played a vital role in developing the design system for the platform. The design system provided a cohesive and standardized approach to visual elements, ensuring consistency across the platform. By implementing a design system, the team facilitated efficient collaboration, expedited design iterations, and maintained a unified user experience. This system is a valuable resource for designers and developers, enabling them to implement and align design elements throughout the platform effectively.

Exposit fintech software development services were primarily focused on frontend development, while other teams handled the backend development. The team successfully tackled the project’s challenges, utilizing various tools and integrations to showcase their expertise in delivering a feature-rich platform. The project involved transitioning from the initial single-page application (SPA) to a microfrontend architecture, which required extensive modifications to align with the new architecture.

Through rigorous testing, including requirements testing, API testing, UI testing, regression testing, smoke testing, and exploratory testing, we ensured the quality and reliability of the platform. Our testing tasks within financial software development services encompassed creating test plans per sprint, executing tests for each story, updating test cases based on requirements and design, conducting API and UI testing, reporting bugs, verifying defects, and conducting demo sessions for the development and QA teams.

Exposit’s involvement in Tribal custom financial software development has been instrumental in shaping its success. Our team has made significant contributions through the delivery of essential features, the implementation of a microfrontend architecture, and the enhancement of the payment process. We are committed to our ongoing partnership with Tribal, driving innovation and delivering valuable solutions.

The team has been very responsive and detail-oriented. We’ve seen the work quality constantly improving over time, with the ability to estimate delivery dates more accurately with every new project assigned.

Mohamed Abouhussein

Product manager in Tribal Credit

Tribal’s solution simplifies expense approvals, payments, and international transactions, reducing administrative burden.

Approval Policies and management confirmation mitigate financial risks, ensuring better control and security.

Bulk payment scheduling and recurring payments integration reduce manual effort, improving cash flow management.