Bankish: Credit Scoring System

A core banking software with credit and deposit system.

- Service

- Custom Software Development

- Industry

- FinTech

Customer goal

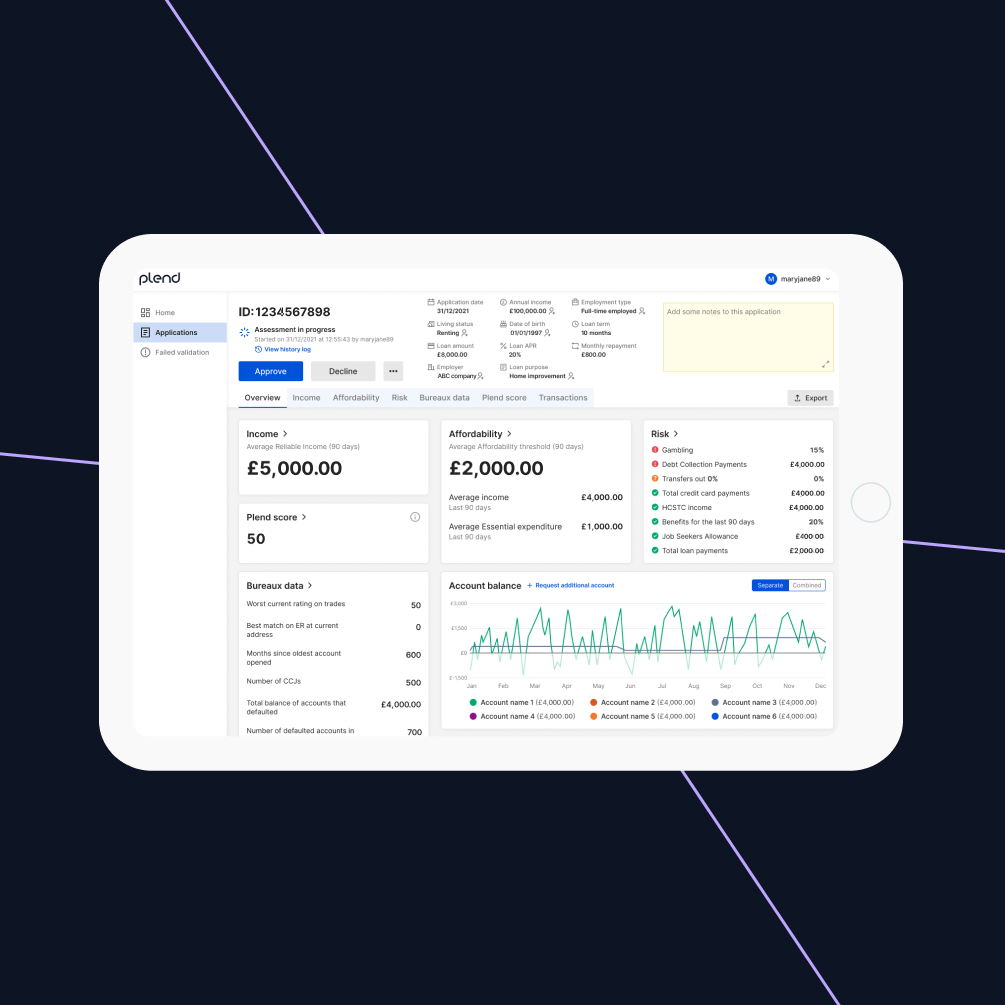

One of the main goals of the system is to help financial institutions reduce the burden on employees and automate the loan issuing process. Our customer provides financial companies with a scoring module in the system to address these needs.

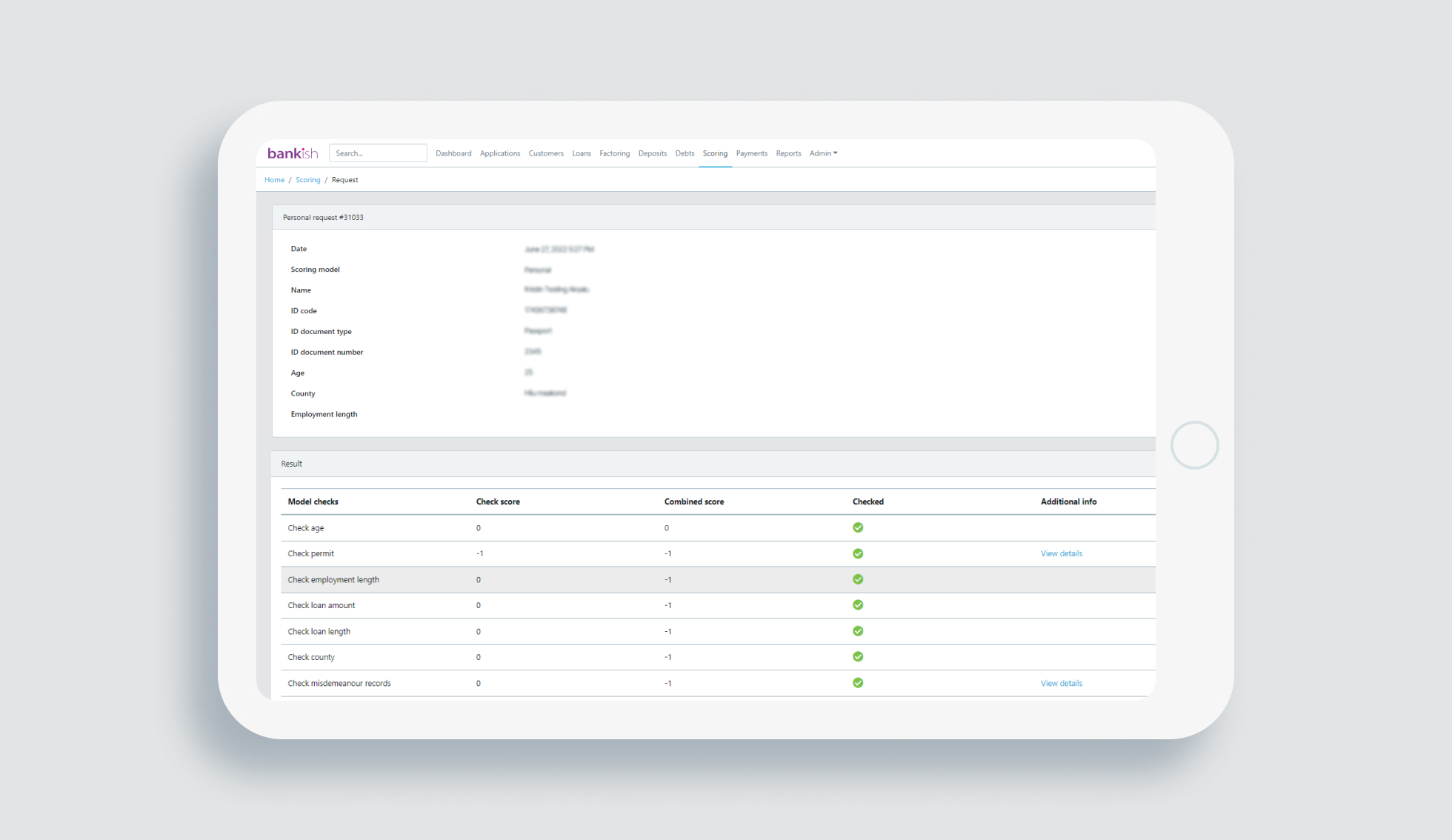

When the loan application is created, the system collects a borrower’s personal data from a profile and other resources: his age, salary level, loan and arrears history, and information about costs; and makes a decision about loan issuing or rejection based on this data using credit scoring model. However, every institution has its own custom criteria for decision-making, and that is the challenge.

The client’s idea of scoring has been implemented without the ability of easy customization: the development team has to make changes in code to customize a solution for every institution, and our customer waste time and money instead of making a profit. Since the module hasn’t covered the initial client’s goals, we’ve provided finance software development services and helped to finalize the scoring mechanism and add the ability of easy customization.

Solution

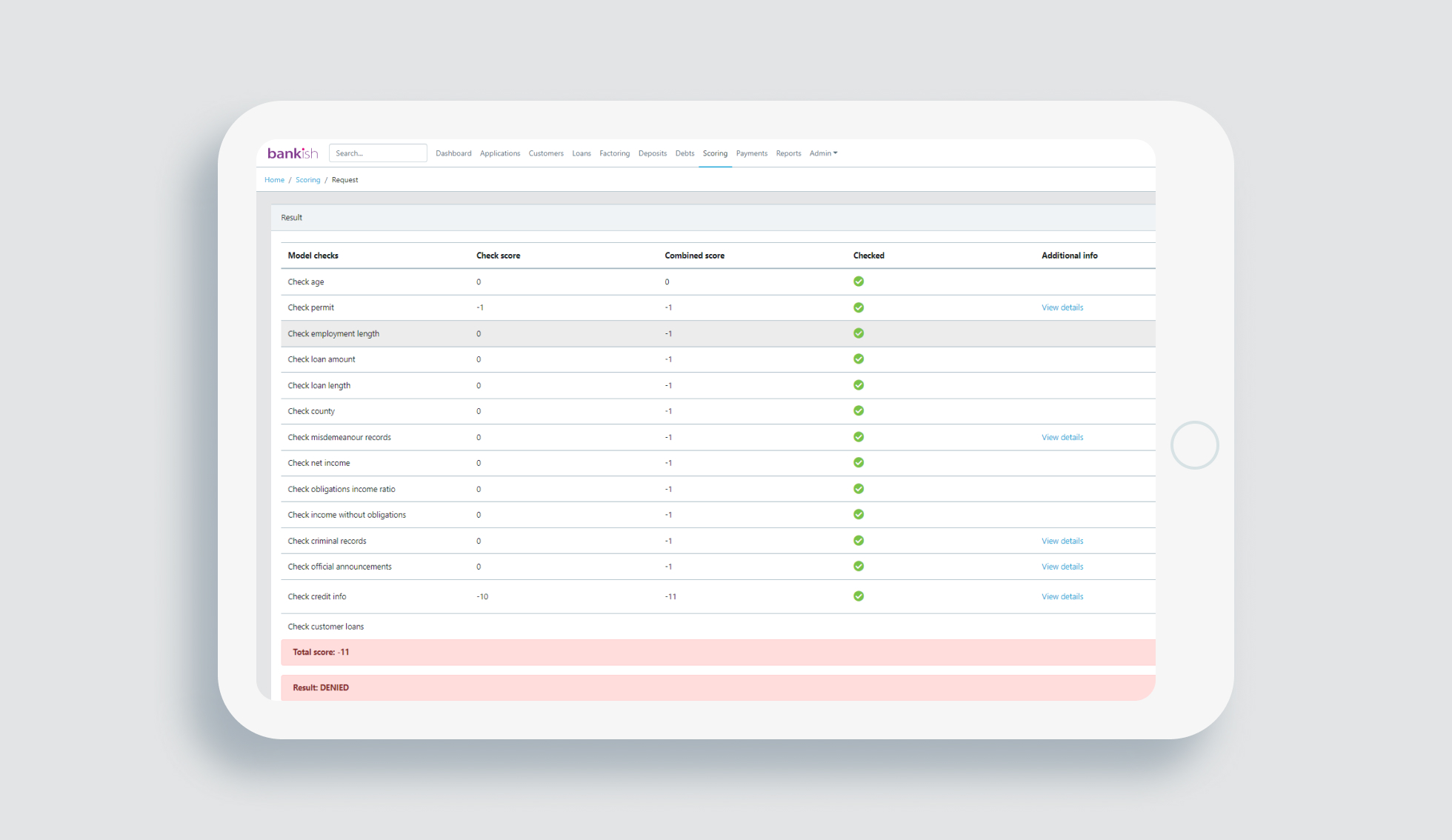

We implemented the scoring module while custom financial software development to help our client automatically assess a borrower’s capacity to pay for loan issuing. The system approves or rejects small amounts automatically, substantial amounts are reviewed by the system and then manually by managers.

The decision on loans is based on the bank scoring system’s assessments of capacity to pay; it is summed, and then the system approves or rejects a loan application.

The capacity to pay is calculated based on the following criteria as an example:

- the user is 28 years old: assessed as 10 points;

- his salary is more than 1000$: 10 points;

- he has an apartment: 10 points;

- but he already has 2 loans: –15 points;

- and his costs exceed revenues: –20 points.

The system assesses the capacity to pay as –5 points and rejects a loan.

Now, our client’s team can make custom changes in the scoring criteria for every client right in the interface of the system. Also, we’ve implemented microservice architecture. We split one monolith app into smaller parties to reduce dependence, making it easier to support and integrate the module with different systems to ensure our client can provide more partners with their core banking products.

Automated loan processing reduces employee workload, improving efficiency.

Customizable credit scoring ensures accurate evaluation of borrowers, minimizing default risks.

Microservice architecture allows easy customization and integration, facilitating product expansion to more partners.